san francisco sales tax rate breakdown

The California sales tax rate is currently. 073 average effective rate.

Sales Tax Collections City Performance Scorecards

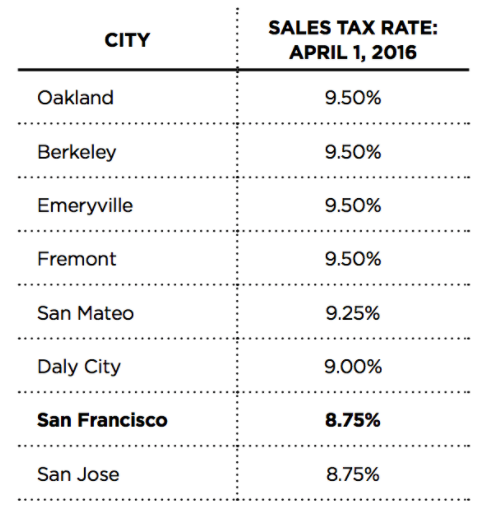

The minimum combined sales tax rate for San Francisco California is 85.

. Ad Find Out Sales Tax Rates For Free. In addition to the. The sales tax jurisdiction name is San Jose Hotel.

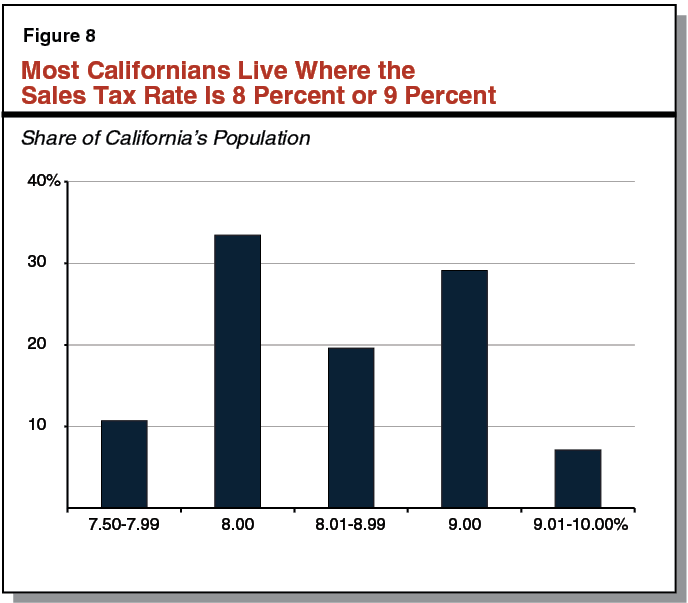

California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. Average Sales Tax With Local. Oceanside CA Sales Tax Rate.

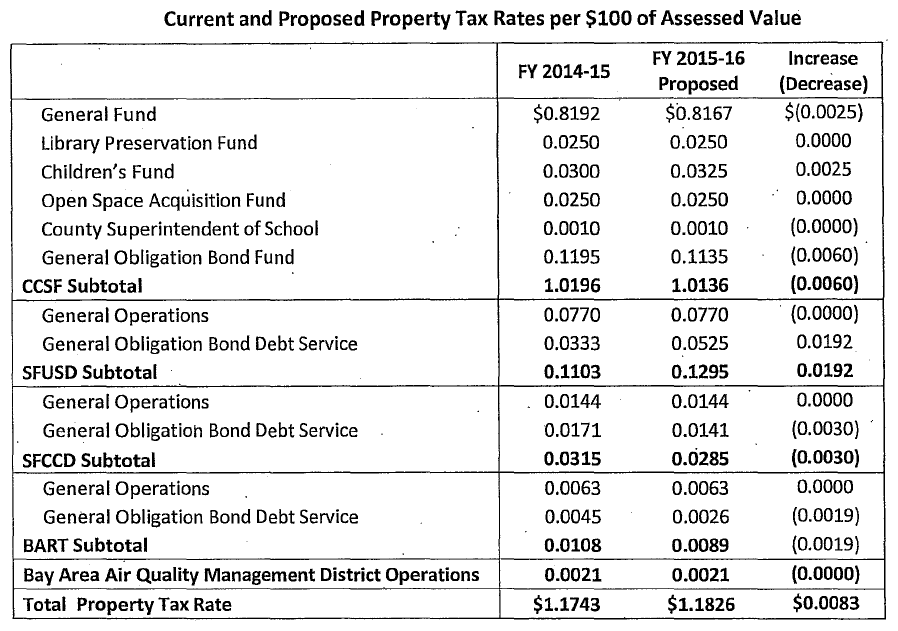

Due to varying local sales tax rates we strongly. In San Francisco transfer taxes upon change of ownership are typically paid by the Seller though it can be otherwise agreed to in the purchase contract. This scorecard presents timely.

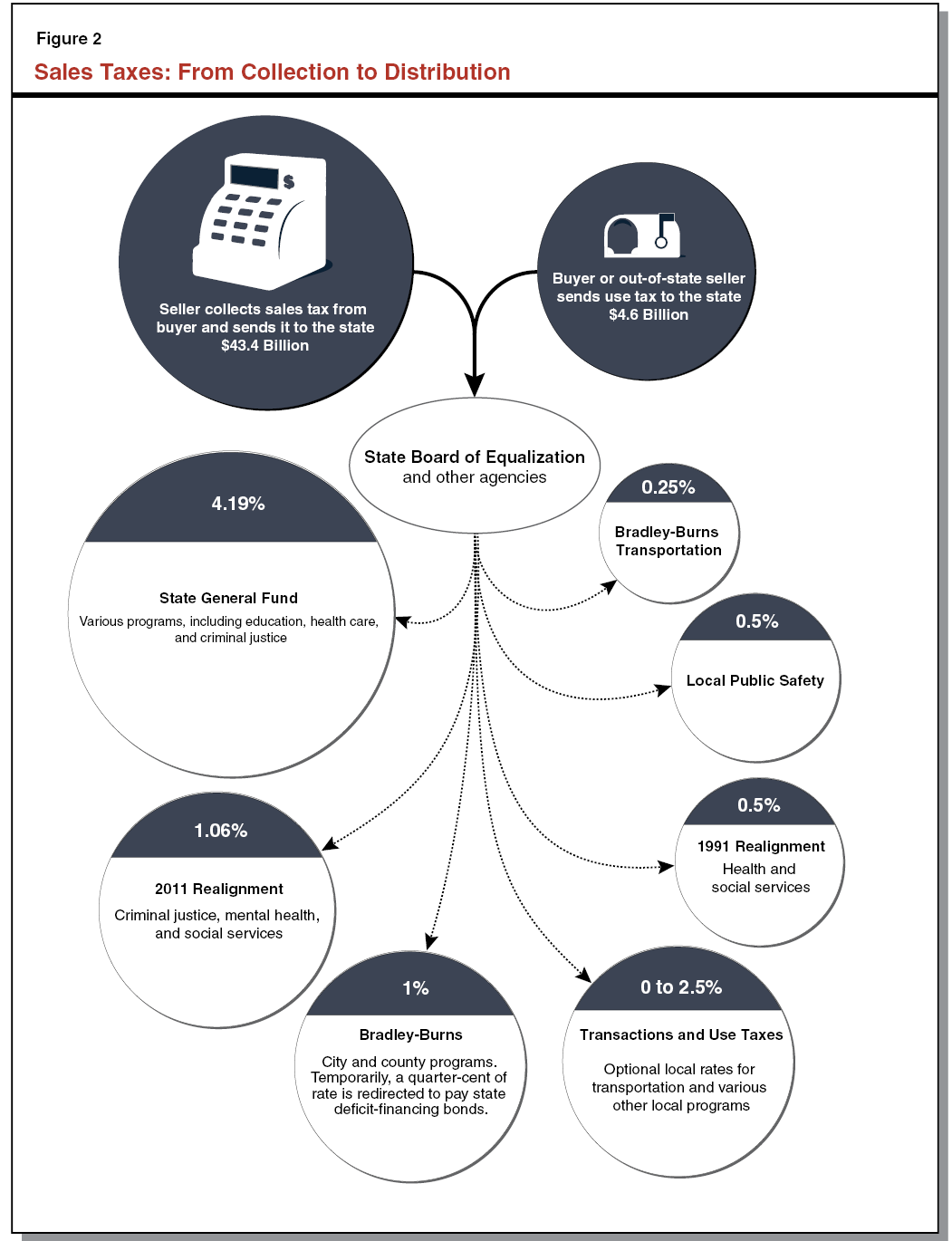

Mandatory local rate 125. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The statewide tax rate is 725.

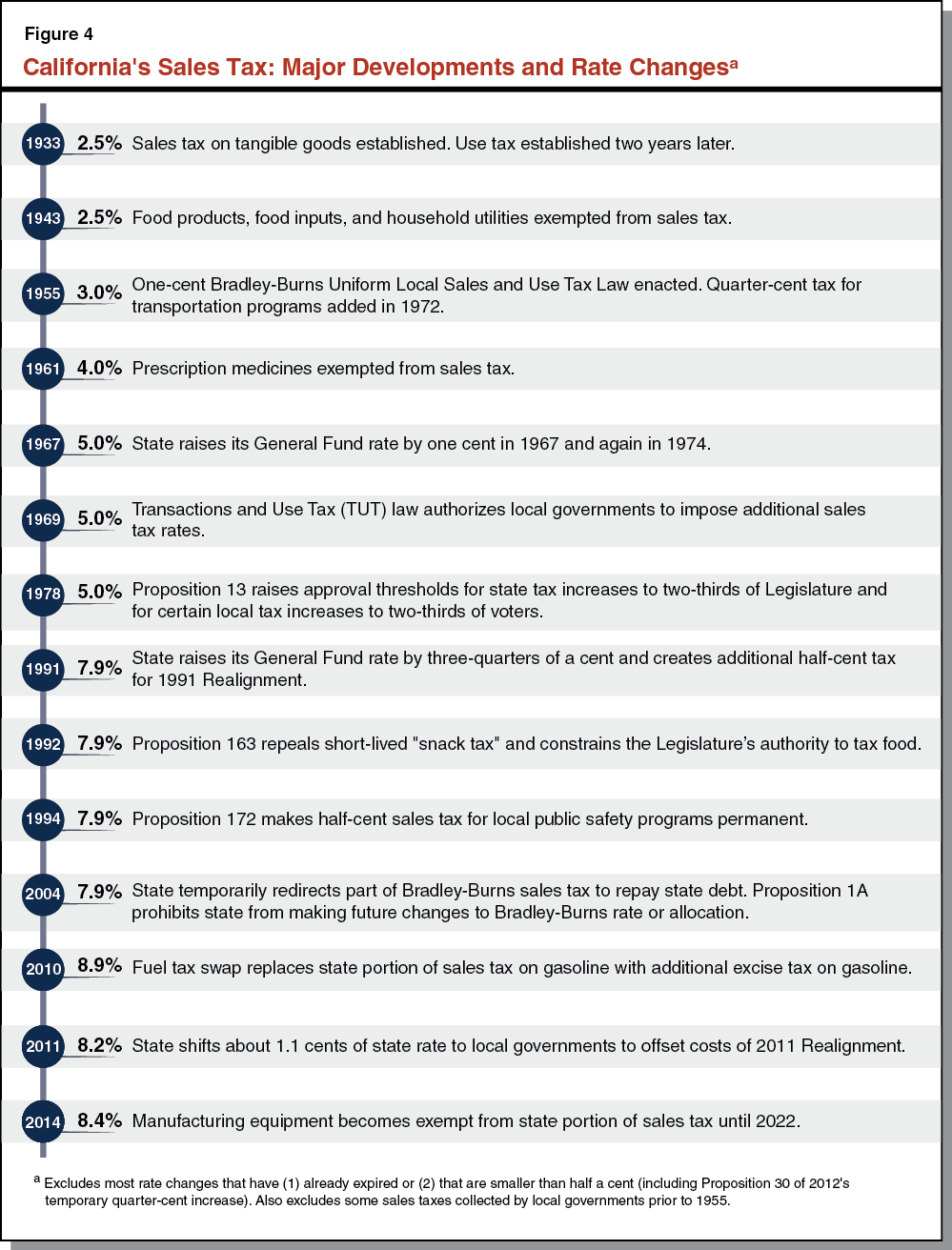

Goes to States General Fund. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel.

Base state sales tax rate 60. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. 4 rows 8625 tax breakdown.

Sales Tax Breakdown. State Sales Tax Rates 1 View local sales taxes. Fast Easy Tax Solutions.

This is the total of state county and city sales tax rates. The state sales tax rate in California is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. Revenue and Taxation Code Sections.

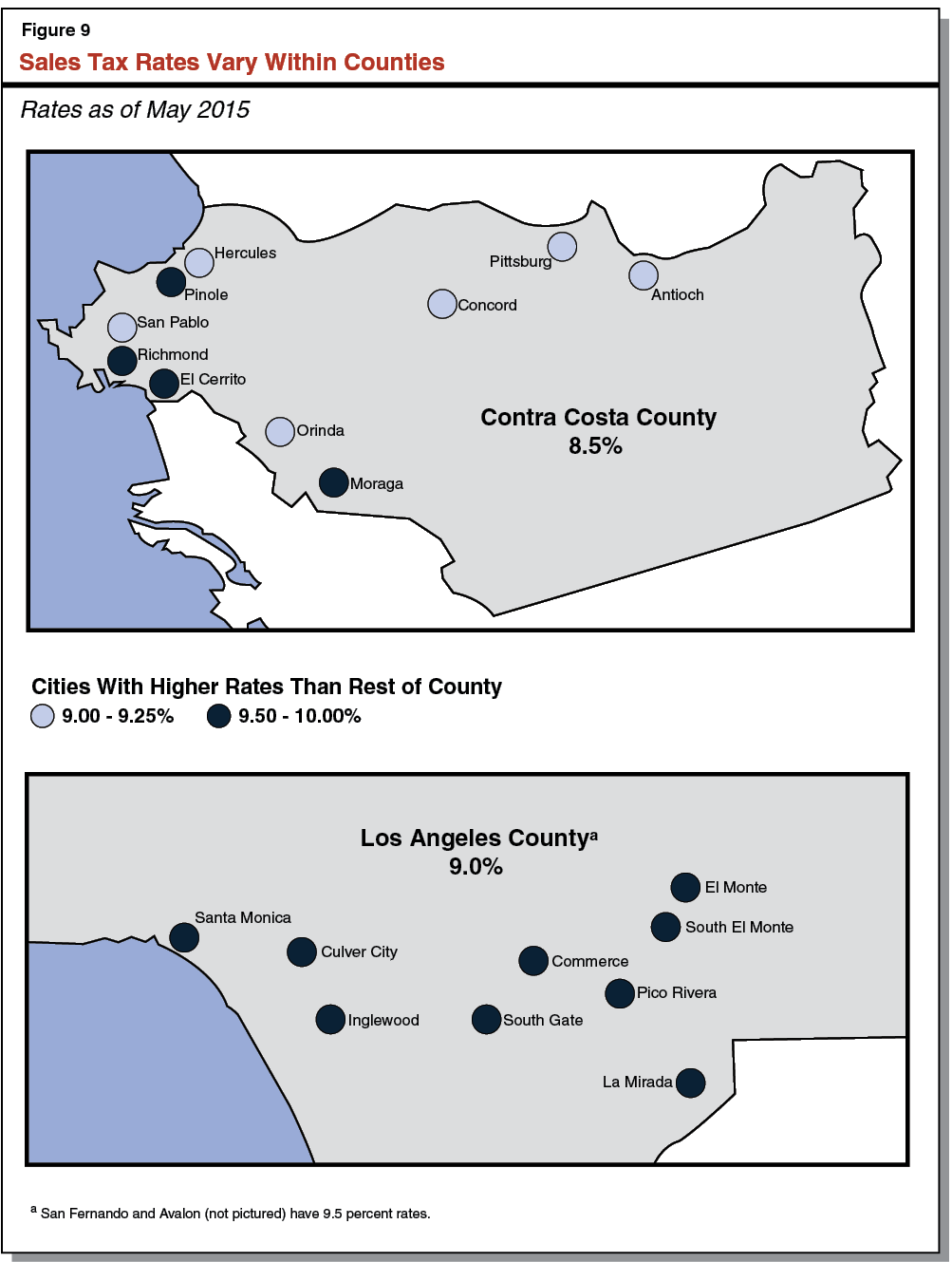

6 rows The San Francisco County California sales tax is 850 consisting of 600 California state. Local rate range 0153. The total sales tax rate in any given location can be broken down into state county city.

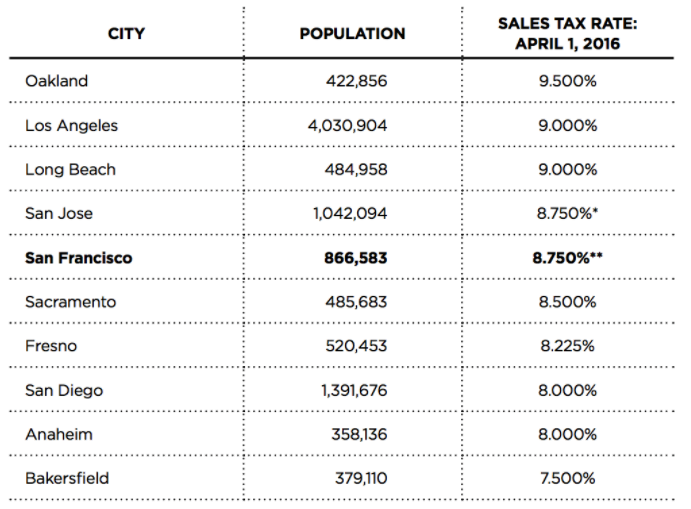

Oakland CA Sales Tax Rate. San Francisco Tourism Improvement District. The minimum combined 2022 sales tax rate for Fresno California is.

Oxnard CA Sales Tax Rate. This is the total of state county and city sales tax rates. Oxnard Shores CA Sales Tax Rate.

Components of the Statewide 725 Sales and Use Tax Rate. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state. Choose any state for more information including local and municiple sales tax rates is applicable.

This is the total of state county and city sales tax rates. Presidio San Francisco 8625. Total rate range 7251025.

The current total local sales tax rate in South. South San Francisco CA Sales Tax Rate. 4 rows Sales Tax Breakdown.

Those district tax rates range from 010 to 100. How much is sales tax in San Francisco. If entire value or consideration is X then.

Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. A base sales and use tax rate of 725 percent is applied statewide. Presidio of Monterey Monterey 9250.

The sales and use tax rate varies depending where the item is bought or will be used. The minimum combined 2022 sales tax rate for San Jose California is. What is the sales tax rate in San Jose California.

Sales tax region name. For state use tax rates see Use Tax By State.

California Sales Use Tax Guide Avalara

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

California Sales Tax Rate By County R Bayarea

California City County Sales Use Tax Rates

Understanding California S Sales Tax

Understanding California S Sales Tax

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

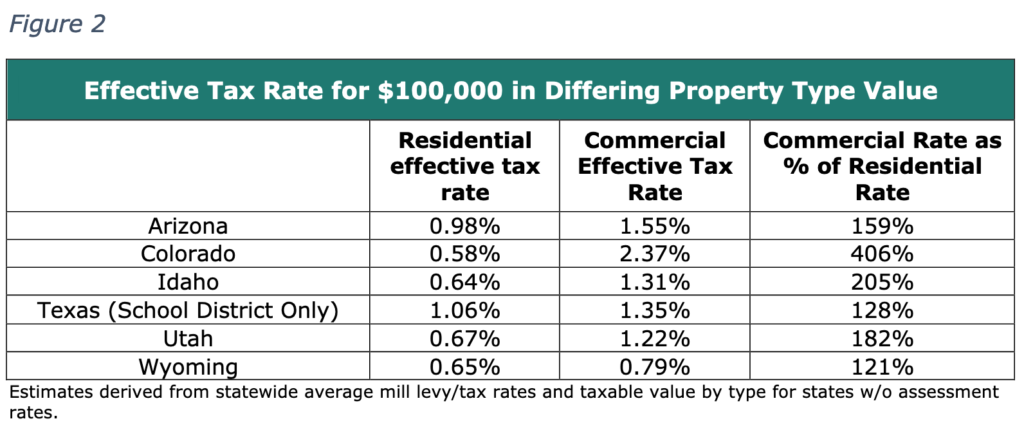

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Us Sales Tax On Orders Brightpearl Help Center

California Sales Tax Rates By City County 2022

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

Understanding California S Sales Tax

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop